Best Practices for Using a Mortgage Payment Calculator When Budgeting Your Finances

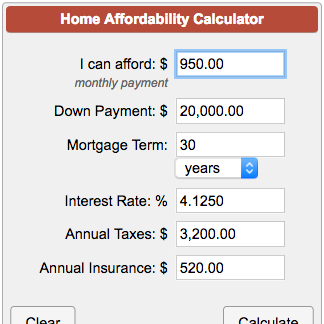

When it comes to managing your finances, especially when planning to buy a home, understanding how much you can afford is crucial. A mortgage payment calculator is one of the most effective tools available to help you estimate your monthly payments and determine what fits within your budget. This tool simplifies complex calculations and provides…