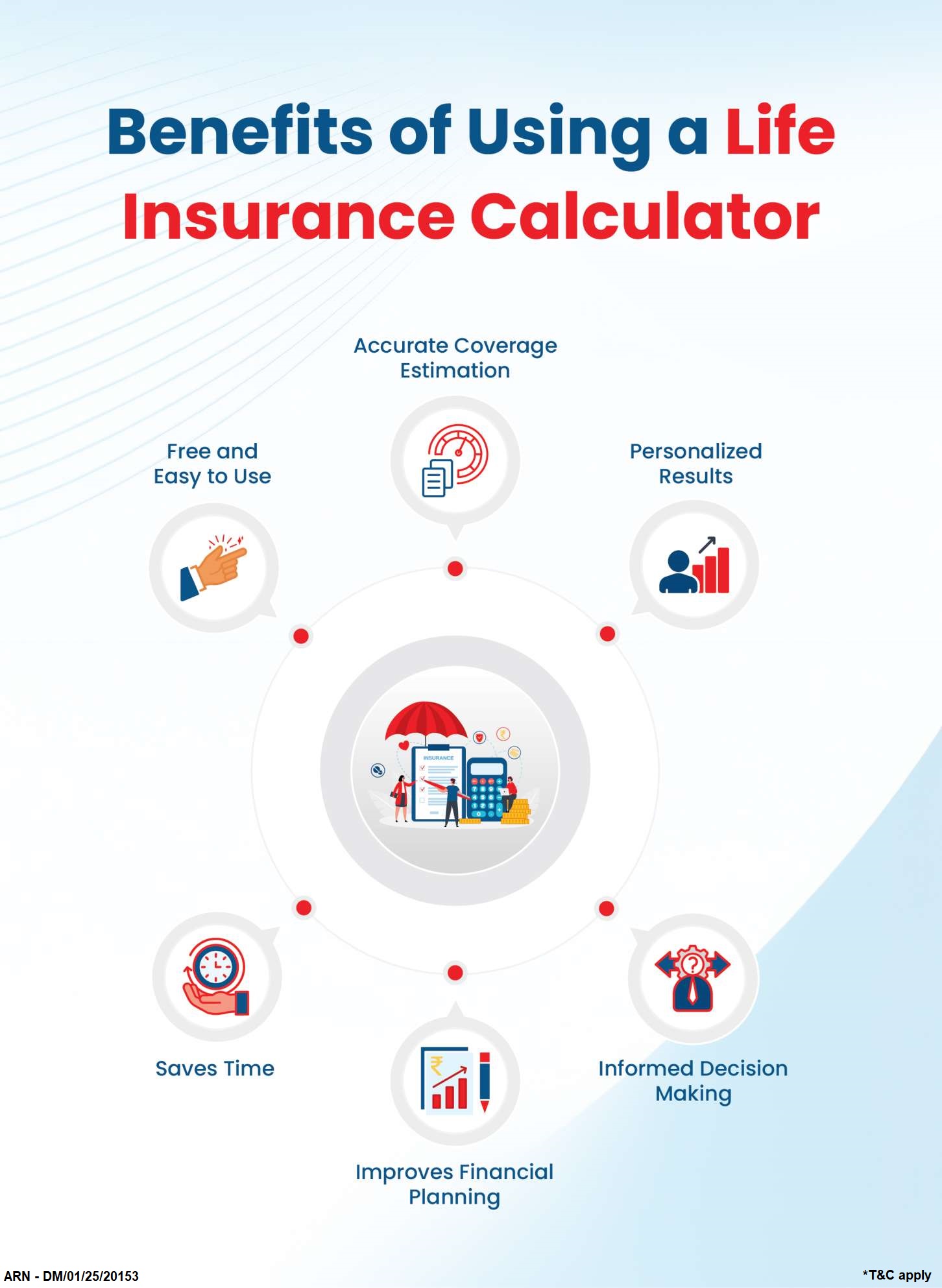

Top 7 Benefits of Using an Insurance Premium Calculator Before Choosing a Policy

When it comes to purchasing insurance, whether it’s life, health, car, or any other type of coverage, one of the most critical decisions is determining the right policy that fits your needs and budget. This decision can be overwhelming due to the variety of options available in the market. However, there is a tool that simplifies this process significantly — an insurance premium calculator.

An insurance premium calculator is an online tool designed to help you estimate the cost of your insurance policy based on various factors like age, income, coverage amount, and more. It provides clarity and helps you make informed decisions without unnecessary confusion. In this article, we will explore the top 7 benefits of using an insurance premium calculator before choosing a policy.

1. Helps You Plan Your Budget Effectively

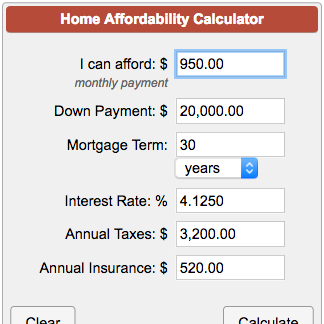

One of the primary benefits of using an insurance premium calculator is its ability to assist in financial planning. Insurance premiums are recurring expenses that need to fit within your monthly or yearly budget.

- By entering details like your desired coverage amount and policy term into the calculator, you can get an accurate estimate of how much you’ll need to pay.

- This allows you to plan your finances better and ensures that you don’t overcommit financially.

- For example:

- If you’re considering a health insurance plan for your family but have limited resources, the calculator helps you adjust coverage levels until you find a premium amount that works for you.

Without knowing how much you’ll need to pay upfront, there’s always a risk of choosing a policy that’s too expensive or doesn’t provide enough value for money.

2. Saves Time by Providing Instant Results

Gone are the days when you’d have to visit multiple agents or companies just to get quotes for different policies. With an insurance premium calculator:

- You can get instant results by simply entering some basic information.

- There’s no need for lengthy meetings or waiting for callbacks from agents.

- The entire process takes just a few minutes.

For instance:

- If you’re comparing car insurance policies from three different providers, instead of contacting each company individually, you can use their respective calculators online and get all the information instantly.

This time-saving feature makes it easier for busy individuals who want quick answers without compromising on accuracy.

3. Enables Comparison Between Multiple Policies

Another significant advantage is that these calculators allow you to compare various policies side by side. When shopping for insurance:

- It’s essential to evaluate different options before making a final decision.

- Premium calculators let you see how changes in coverage amounts or add-ons affect your overall costs across multiple insurers.

For example:

- If two companies offer similar health plans but one has higher premiums due to additional features like maternity benefits or wellness programs, you’ll be able to identify which option suits your needs better.

By comparing policies effectively:

- You avoid overpaying for unnecessary features.

- You ensure you’re getting maximum value out of every dollar spent on premiums.

4. Provides Transparency in Pricing

Insurance pricing can sometimes feel confusing due to hidden charges or unclear terms. An insurance premium calculator eliminates this issue by providing complete transparency:

- It breaks down exactly what you’re paying for — including base premiums and any additional costs associated with riders (add-ons).

For instance:

- If you’re buying life insurance with critical illness coverage as an add-on rider:

- The calculator will show how much extra you’ll need to pay specifically for that rider.

This level of detail ensures there are no surprises later when it comes time to make payments.

Transparency builds trust between customers and insurers while empowering individuals with knowledge about their financial commitments upfront.

5. Customizes Policies Based on Individual Needs

No two individuals have identical financial situations or requirements when it comes to insurance coverage. A young professional starting their career will have vastly different needs compared to someone nearing retirement age with dependents relying on them financially.

Using an insurance premium calculator allows customization by letting users input specific details such as:

- Age

- Gender

- Income

- Desired sum assured

- Policy term

Based on these inputs:

- The tool generates personalized estimates tailored specifically for each user’s unique circumstances.

For example:

- A 25-year-old looking for term life insurance might prioritize affordability over extensive coverage since they’re at low risk currently.

- On the other hand, someone aged 50 may focus more on comprehensive protection even if it means higher premiums because they have greater responsibilities (like children’s education).

Customization ensures everyone finds policies aligned perfectly with their goals without wasting money on irrelevant features.

6. Encourages Informed Decision-Making

Making uninformed decisions about something as important as insurance can lead not only to financial strain but also inadequate protection during emergencies. An insurance premium calculator empowers users by providing all necessary information upfront so they can make well-informed choices confidently:

Key Points Here Include:

- Understanding how much coverage is affordable within current budgets.

- Knowing exactly what each policy offers in terms of benefits versus costs.

- Experimenting with different scenarios (e.g., shorter vs longer terms) before committing fully.

By experimenting freely without pressure from sales agents pushing specific products onto customers blindly – people feel more confident selecting plans independently after thorough analysis using calculators first-hand!

7. Reduces the Risk of Overpaying or Underinsuring Yourself

One of the most critical benefits of using an insurance premium calculator is that it helps you strike the perfect balance between affordability and adequate coverage. Without proper tools, many people either end up overpaying for unnecessary features or underinsuring themselves, which can lead to financial difficulties during emergencies.

Here’s why this is important:

- Avoid Overpaying: By using a premium calculator, you can clearly see how much each feature or rider adds to your total premium. This allows you to eliminate unnecessary add-ons that don’t align with your needs, ensuring you’re not paying for something you won’t use.

- For example: If a car insurance policy includes roadside assistance but you already have this service through another provider, the calculator will show how removing this feature reduces your premium.

- Prevent Underinsurance: On the other hand, underestimating your coverage needs can leave you vulnerable in times of crisis. A premium calculator ensures that you select a policy with sufficient coverage while staying within your budget.

- For instance: If you’re purchasing health insurance for your family, the tool will help you determine whether increasing the sum insured slightly would provide better protection without significantly raising premiums.

By reducing these risks, an insurance premium calculator ensures that every dollar spent on premiums contributes directly to your financial security and peace of mind.

Conclusion

Choosing the right insurance policy is one of the most important financial decisions you’ll make. With so many options available in today’s market, it’s easy to feel overwhelmed or make mistakes that could cost you dearly in the long run. This is where an insurance premium calculator becomes an invaluable tool.

To summarize, here are the top 7 benefits of using an insurance premium calculator before choosing a policy:

- It helps you plan your budget effectively by providing accurate estimates.

- It saves time by delivering instant results without lengthy processes.

- It enables easy comparison between multiple policies from different insurers.

- It provides transparency in pricing by breaking down costs clearly.

- It customizes policies based on individual needs and circumstances.

- It encourages informed decision-making by offering detailed insights upfront.

- It reduces the risk of overpaying or underinsuring yourself by striking a balance between cost and coverage.

By leveraging this simple yet powerful tool, you can take control of your insurance planning process and ensure that every decision aligns with your financial goals and personal requirements. Whether you’re buying life insurance for long-term security, health insurance for medical emergencies, or car insurance for vehicle protection — starting with a premium calculator puts you on the right path toward making smarter choices.

In today’s fast-paced world where financial stability is more critical than ever before, tools like these empower individuals to make confident decisions without relying solely on agents or guesswork. So next time you’re considering purchasing any type of insurance policy, remember to use an insurance premium calculator as your first step toward securing a better future!