How Accurate Are Mortgage Calculators? Tips for Getting Reliable Results Every Time!

When it comes to buying a home or planning your finances for a mortgage, one of the first tools many people turn to is a mortgage calculator. These online tools are widely available and promise quick answers to questions like “How much can I borrow?” or “What will my monthly payments look like?” But how accurate are these calculators, really? Can you rely on them to make one of the biggest financial decisions of your life? Let’s break it down step by step and explore tips for getting reliable results every time.

What Is a Mortgage Calculator?

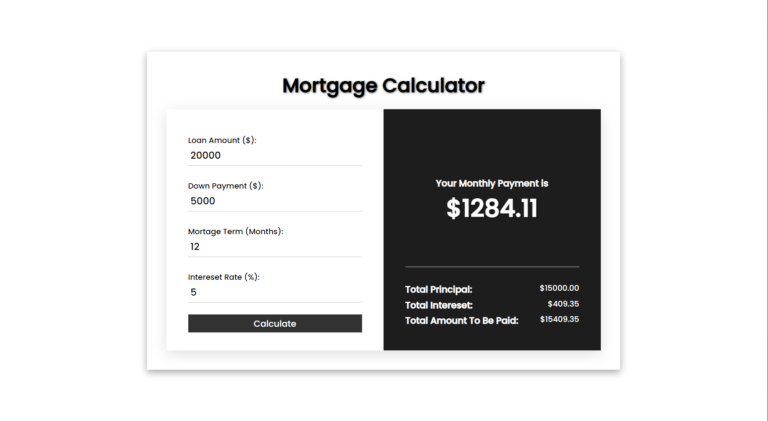

A mortgage calculator is an online tool designed to help you estimate various aspects of your mortgage. Depending on the type of calculator, it might calculate:

- Monthly mortgage payments

- Loan affordability based on your income

- Total interest paid over the life of the loan

- Amortization schedules (breakdown of principal vs. interest payments)

These calculators typically require you to input basic information such as:

- Loan amount

- Interest rate

- Loan term (e.g., 15 years or 30 years)

- Down payment amount

Some advanced calculators also allow you to include additional costs like property taxes, homeowner’s insurance, private mortgage insurance (PMI), and HOA fees.

How Do Mortgage Calculators Work?

Mortgage calculators use mathematical formulas to compute results based on the inputs you provide. For example:

- Monthly Payment Calculation:

The formula used is:

M=P×r(1+r)n(1+r)n−1

Where:- M = Monthly payment

- P = Loan amount (principal)

- r = Monthly interest rate (annual rate divided by 12)

- n = Total number of payments (loan term in months)

- Amortization Schedule:

This breaks down each monthly payment into two parts:- Principal: The portion that reduces your loan balance.

- Interest: The cost of borrowing money.

- Affordability Calculations:

Some calculators use income multiples (e.g., 4x or 5x your annual income) or debt-to-income ratios to estimate how much you can afford to borrow.

While these formulas are accurate in theory, their real-world accuracy depends heavily on the quality and completeness of the data entered.

Are Mortgage Calculators Accurate?

The short answer is yes and no. Mortgage calculators can be accurate for providing rough estimates, but they often fall short when it comes to giving precise numbers. Here’s why:

Factors That Affect Accuracy

- Incomplete Inputs:

- Many basic mortgage calculators only ask for loan amount, interest rate, and term.

- They often ignore critical costs like property taxes, homeowner’s insurance, PMI, and HOA fees.

- Without these additional costs factored in, your estimated monthly payment could be significantly lower than reality.

- Assumptions About Interest Rates:

- Most calculators assume a fixed interest rate throughout the loan term.

- If you’re considering an adjustable-rate mortgage (ARM), this assumption won’t hold true after the initial fixed period ends.

- Generic Property Tax Estimates:

- Some calculators use default property tax rates that may not reflect actual rates in your area.

- Property taxes vary widely depending on location.

- Credit Score Impact:

- Your credit score plays a big role in determining your actual interest rate.

- Many calculators don’t account for this variability and may show rates that only apply to borrowers with excellent credit.

- Market Changes:

- Interest rates fluctuate based on market conditions.

- A calculator using outdated rates won’t give accurate results.

- User Error:

- Entering incorrect or incomplete information can lead to inaccurate results.

- For example, forgetting to include existing debts when calculating affordability could skew results.

Tips for Getting Reliable Results Every Time

To ensure you get the most accurate estimates from a mortgage calculator, follow these tips:

1. Use Detailed Calculators

- Look for calculators that allow you to input all relevant costs:

- Property taxes

- Homeowner’s insurance

- PMI

- HOA fees (if applicable)

- Avoid overly simplistic tools that only calculate principal and interest payments.

2. Research Current Interest Rates

- Check current mortgage rates from reputable sources before using a calculator.

- Use realistic rates based on your credit score and loan type.

3. Factor in Additional Costs Manually

If the calculator doesn’t include certain costs automatically:

- Estimate property taxes by checking local tax rates or asking a real estate agent.

- Get quotes for homeowner’s insurance from insurance providers.

- Include PMI if your down payment is less than 20%.

4. Be Honest About Your Finances

- Input accurate information about your income, debts, and expenses.

- Don’t underestimate monthly expenses just to make numbers look better.

5. Consider Different Scenarios

Run multiple scenarios with different inputs:

- Try higher or lower down payments.

- Adjust loan terms (e.g., compare 15-year vs. 30-year loans).

- Experiment with different interest rates to see how they affect payments.

6. Double Check With Professionals

While mortgage calculators are great starting points:

- Consult with a lender or mortgage broker for personalized advice.

- Get pre-approved for a loan to understand exactly what you qualify for.

Common Mistakes When Using Mortgage Calculators

Even with detailed tools, mistakes can happen if users aren’t careful:

- Ignoring Closing Costs Many buyers forget about upfront costs like appraisal fees, title insurance, and origination fees when budgeting for their home purchase.

- Overestimating Affordability Just because a calculator says you can afford a certain loan doesn’t mean it aligns with your personal budget or lifestyle goals.

- Relying Solely on Advertised Rates Advertised rates often assume perfect credit scores and large down payments—conditions that may not apply to everyone.

- Not Accounting for Future Changes If you’re planning an ARM or expect significant changes in income/expenses over time, static calculations may not reflect reality accurately.

Why You Should Still Use Mortgage Calculators

Despite their limitations, mortgage calculators remain valuable tools:

Benefits of Using Mortgage Calculators

- Quick Estimates:

They provide fast insights into potential costs without needing professional assistance upfront. - Budget Planning:

They help buyers understand how different factors—like down payment size—affect monthly payments. - Scenario Analysis:

Users can experiment with various inputs to explore different financial outcomes before committing to anything concrete. - Educational Value:

Calculators introduce first-time buyers to key concepts like amortization schedules and total interest paid over time.

Final Thoughts

So how accurate are mortgage calculators? The answer depends largely on how detailed they are and how carefully you input data into them! While they’re excellent tools for getting rough estimates and understanding general affordability ranges, they shouldn’t replace professional advice from lenders or brokers who can provide tailored recommendations based on your unique situation.

By following best practices—using detailed tools, researching current rates, factoring in all costs—you can maximize their usefulness while avoiding common pitfalls along the way!

Remember: A good calculator is just one piece of the puzzle; combining it with expert guidance ensures you’ll make informed decisions about one of life’s biggest investments!