Compare Mortgage Rates Easily with These 5 Advanced Online Calculators in 2025

When it comes to buying a home or refinancing an existing mortgage, one of the most important steps is comparing mortgage rates. The interest rate you secure can significantly impact your monthly payments and the total cost of your loan over time. In 2025, advanced online tools have made it easier than ever to compare mortgage rates from multiple lenders in just a few clicks. These calculators are designed to help you make informed decisions by providing accurate estimates based on your financial situation.

In this article, we’ll explore five advanced online mortgage calculators that can simplify the process of comparing rates. We’ll also discuss how these tools work, what factors they consider, and why using them is essential for finding the best deal on your home loan.

Why Compare Mortgage Rates?

Before diving into the tools, let’s understand why comparing mortgage rates is crucial:

- Save Money: Even a small difference in interest rates can save you thousands of dollars over the life of your loan.

- Understand Your Options: Different lenders offer varying terms and conditions. Comparing rates helps you identify which lender suits your needs.

- Plan Your Budget: Knowing your potential monthly payment allows you to plan your finances better.

- Avoid Overpaying: Without comparison, you might end up paying more than necessary for your mortgage.

By using online calculators, you can quickly evaluate multiple offers and choose the one that aligns with your financial goals.

How Do Mortgage Calculators Work?

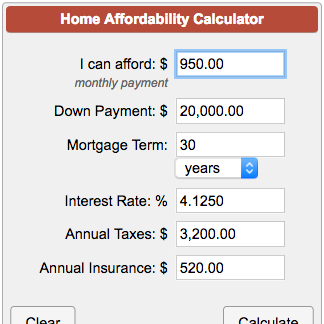

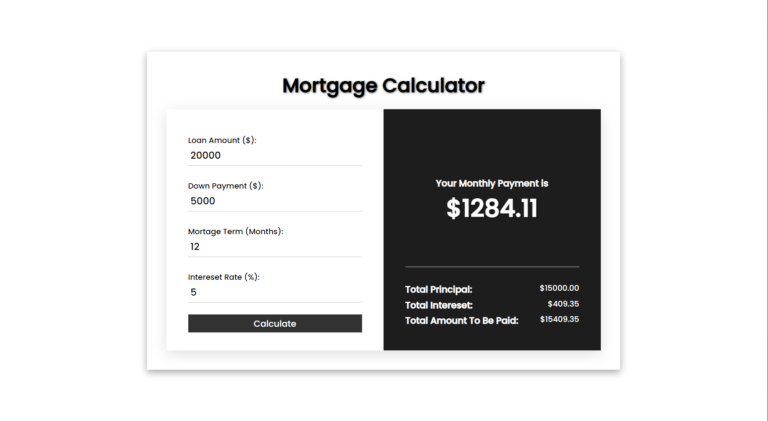

Mortgage calculators use a combination of inputs to estimate your monthly payments and overall costs. Here’s what they typically require:

- Loan Amount: The amount you plan to borrow.

- Interest Rate: The percentage charged by the lender for borrowing money.

- Loan Term: The duration of the loan (e.g., 15 years or 30 years).

- Down Payment: The upfront amount you pay toward the home’s purchase price.

- Property Taxes and Insurance: Additional costs associated with owning a home.

Once these details are entered, the calculator provides an estimate of:

- Monthly principal and interest payments

- Total interest paid over the life of the loan

- Amortization schedule (breakdown of payments over time)

Some advanced calculators also factor in private mortgage insurance (PMI), homeowners association (HOA) fees, and other expenses.

Top 5 Advanced Online Mortgage Calculators in 2025

Here are five highly recommended tools for comparing mortgage rates effectively:

1. Bankrate Mortgage Calculator

Bankrate has been a trusted name in personal finance for decades, and their mortgage calculator is one of the most comprehensive tools available.

Features:

- Allows users to input detailed information such as property taxes, HOA fees, and PMI.

- Provides an amortization schedule showing how much principal and interest you’ll pay each month.

- Offers real-time comparisons with current national average rates.

How It Helps:

- Bankrate’s tool is ideal for those who want a clear breakdown of their monthly payments.

- It also connects users with lenders offering competitive rates based on their location.

Steps to Use:

- Enter your home price and down payment amount.

- Select your loan term (e.g., 15 years or 30 years).

- Input additional costs like property taxes or insurance if applicable.

- View detailed results instantly.

2. NerdWallet Mortgage Calculator

NerdWallet’s calculator stands out for its user-friendly interface and personalized recommendations.

Features:

- Customizable inputs for credit score, ZIP code, and down payment percentage.

- Displays estimated APR alongside interest rate for better comparison.

- Includes options for FHA loans, VA loans, USDA loans, and conventional mortgages.

How It Helps:

- NerdWallet’s tool not only calculates payments but also suggests lenders tailored to your financial profile.

- It’s perfect for first-time buyers looking for guidance on different loan types.

Steps to Use:

- Enter basic details like loan amount and term length.

- Adjust sliders for credit score and down payment percentage.

- Compare personalized lender offers side-by-side.

3. Zillow Mortgage Calculator

Zillow is widely known as a real estate platform, but its mortgage calculator is equally impressive when it comes to rate comparison.

Features:

- Integrates seamlessly with Zillow’s property listings so you can calculate payments directly while browsing homes.

- Offers adjustable graphs showing how changes in interest rate affect monthly payments.

- Includes options for fixed-rate mortgages (FRMs) and adjustable-rate mortgages (ARMs).

How It Helps:

- Zillow’s tool simplifies house hunting by combining property search with financing calculations.

- It’s great for buyers who want an all-in-one solution without switching between platforms.

Steps to Use:

- Search for properties on Zillow or enter a specific home price manually.

- Input financing details like down payment percentage and loan type.

- View estimated monthly costs along with property details.

4. LendingTree Mortgage Comparison Tool

LendingTree takes things up a notch by allowing users to compare multiple lender offers simultaneously through its platform.

Features:

- Aggregates live quotes from various lenders based on user inputs.

- Provides detailed Loan Estimates including APRs, closing costs, and fees.

- Offers prequalification options without affecting credit scores.

How It Helps:

- LendingTree saves time by eliminating the need to visit individual lender websites.

- Its side-by-side comparison feature ensures transparency in choosing the best deal.

Steps to Use:

- Fill out a short form with basic financial information (income level, credit score range).

- Receive customized quotes from multiple lenders within minutes.

- Compare offers based on interest rate, APRs & other terms before applying directly through LendingTree’s platform.

5: MortgageCalculator.org

This straightforward yet powerful tool focuses solely on providing accurate calculations without distractions or ads cluttering up space!

Features Include:

- Simple interface designed specifically around usability!

- No unnecessary distractions unlike competitors making sure focus remains purely upon numbers themselves rather than flashy gimmicks distracting away core purpose behind visiting site initially!

6. Redfin Mortgage Calculator

Redfin is a well-known real estate platform, and its mortgage calculator is designed to integrate seamlessly with its property listings while offering detailed financial insights.

Features:

- Allows users to calculate monthly payments directly while browsing homes on Redfin.

- Provides a breakdown of principal, interest, taxes, and insurance (PITI).

- Includes options for fixed-rate and adjustable-rate mortgages.

- Offers an interactive graph showing how different loan terms or down payment amounts affect monthly costs.

How It Helps:

The Redfin mortgage calculator is perfect for homebuyers who are actively searching for properties on the platform. It simplifies the process by combining property search with financing calculations in one place.

Steps to Use:

- Search for a property on Redfin or manually enter the home price.

- Input your down payment percentage and loan term.

- Adjust other variables like interest rate or property taxes if needed.

- View detailed results, including total monthly payments and estimated closing costs.

7. Quicken Loans (Rocket Mortgage) Calculator

Quicken Loans, now operating as Rocket Mortgage, offers a highly advanced mortgage calculator that focuses on providing personalized results based on user inputs.

Features:

- Customizable inputs for credit score, income level, and debt-to-income ratio.

- Offers prequalification estimates without impacting your credit score.

- Displays real-time interest rates based on current market conditions.

- Includes tools to compare refinancing options alongside new purchase loans.

How It Helps:

Rocket Mortgage’s calculator is ideal for those who want a tailored experience that takes into account their unique financial situation. It also connects users directly with Rocket Mortgage advisors for further assistance.

Steps to Use:

- Enter basic details like loan amount, term length, and down payment percentage.

- Provide additional information about your credit score range and income level.

- View personalized loan options with estimated monthly payments and APRs.

- Apply directly through Rocket Mortgage if you find a suitable option.

8. Mortgage Professor’s Calculator Suite

Mortgage Professor offers a suite of calculators designed to address various aspects of home financing, from comparing rates to evaluating refinancing options.

Features:

- Includes multiple calculators for specific needs (e.g., affordability calculator, refinance breakeven calculator).

- Provides detailed explanations of each calculation to help users understand the results.

- Offers side-by-side comparisons of different loan scenarios.

How It Helps:

This tool is perfect for those who want in-depth analysis and education about their mortgage options. The variety of calculators ensures that every aspect of home financing is covered.

Steps to Use:

- Choose the specific calculator that matches your needs (e.g., rate comparison or affordability).

- Enter the required details such as loan amount, interest rate, and term length.

- Review detailed results along with explanatory notes provided by the tool.

- Experiment with different scenarios to see how changes impact your finances.

9. SmartAsset Mortgage Calculator

SmartAsset’s mortgage calculator stands out for its interactive features and comprehensive approach to estimating costs associated with buying a home.

Features:

- Provides an interactive map showing average property taxes by location.

- Includes detailed breakdowns of principal, interest, taxes, insurance (PITI), and PMI if applicable.

- Offers recommendations for lenders based on user inputs.

How It Helps:

SmartAsset’s tool goes beyond basic calculations by incorporating local data into its estimates. This makes it particularly useful for buyers who want accurate projections tailored to their area.

Steps to Use:

- Enter key details like home price, down payment amount, and loan term.

- Adjust sliders for variables such as interest rate or property taxes based on location-specific data provided by SmartAsset.

- View comprehensive results along with lender recommendations if desired.

10: USAA Mortgage Payment Calculator

USAA caters primarily to military members and their families but offers a robust mortgage payment calculator accessible to all users online.

Features:

- Designed specifically around VA loans but supports conventional mortgages too!

- Simple interface focusing purely upon usability ensuring no distractions occur during usage itself!

- Breakdown includes PITI alongside optional PMI inclusion depending upon circumstances surrounding individual cases themselves!

How It Helps:

Military personnel often face unique challenges when securing housing finance solutions so having dedicated resource catering exclusively towards them proves invaluable indeed especially given added complexities involved therein!

Steps Include: Simply entering desired values pertaining respective fields before reviewing outputted figures accordingly thereafter!