Fixed vs Adjustable Rate Mortgages: How Calculators Help You Choose the Right Option

When it comes to buying a home, one of the most critical decisions you’ll face is choosing the right type of mortgage. Fixed-rate and adjustable-rate mortgages (ARMs) are two of the most common options available to homebuyers. Each has its own set of advantages and disadvantages, and understanding these differences is essential for making an informed decision. Fortunately, mortgage calculators can play a significant role in helping you evaluate your options and choose the best fit for your financial situation.

In this article, we’ll break down fixed-rate mortgages, adjustable-rate mortgages, their key differences, and how calculators can simplify the decision-making process. By the end, you’ll have a clear understanding of how to use these tools effectively to make a confident choice.

What Is a Fixed-Rate Mortgage?

A fixed-rate mortgage is one where the interest rate remains constant throughout the life of the loan. This means that your monthly principal and interest payments will stay the same from start to finish. Fixed-rate mortgages are popular among buyers who value stability and predictability in their financial planning.

Key Features of Fixed-Rate Mortgages:

- Consistent Monthly Payments: Your payment amount remains unchanged for the entire term.

- Long-Term Options: Common terms include 10, 15, 20, or 30 years.

- Higher Initial Rates: Typically higher than ARMs at the start but offer long-term security.

- No Surprises: You’re protected from market fluctuations in interest rates.

Pros of Fixed-Rate Mortgages:

- Budgeting becomes easier since payments are predictable.

- Protection against rising interest rates over time.

- Ideal for long-term homeowners who plan to stay in their property for many years.

Cons of Fixed-Rate Mortgages:

- Higher initial interest rates compared to ARMs.

- If market rates drop significantly, you may need to refinance to take advantage of lower rates.

What Is an Adjustable-Rate Mortgage (ARM)?

An adjustable-rate mortgage (ARM) has an interest rate that changes periodically after an initial fixed period. For example, a 5/1 ARM means that the rate is fixed for five years and then adjusts annually based on market conditions. ARMs often start with lower initial rates compared to fixed-rate mortgages but come with more uncertainty over time.

Key Features of Adjustable-Rate Mortgages:

- Lower Initial Rates: Often lower than fixed-rate loans during the introductory period.

- Adjustment Periods: After the fixed period ends, rates adjust annually or at other intervals.

- Caps on Adjustments: Limits on how much rates can increase per adjustment period or over the life of the loan.

Pros of Adjustable-Rate Mortgages:

- Lower initial payments make them attractive for short-term homeowners or first-time buyers.

- Potential savings if market rates decrease during adjustment periods.

Cons of Adjustable-Rate Mortgages:

- Payments can increase significantly if market rates rise.

- Less predictable monthly costs after adjustments begin.

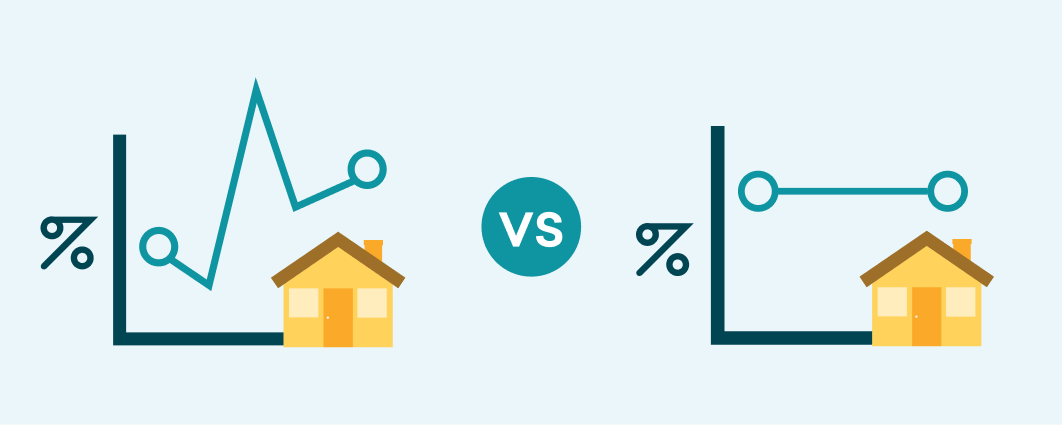

Key Differences Between Fixed and Adjustable Rate Mortgages

Understanding how these two types differ is crucial when deciding which one suits your needs:

| Feature | Fixed Rate Mortgage | Adjustable Rate Mortgage (ARM) |

| Interest Rate Stability | Remains constant | Changes after initial fixed period |

| Monthly Payment | Predictable | Can fluctuate |

| Initial Interest Rates | Higher | Lower |

| Long-Term Costs | Easier to estimate | Harder to predict |

| Best For | Long-term homeowners | Short-term homeowners |

How Mortgage Calculators Can Help

Mortgage calculators are powerful tools that allow you to compare different loan options by providing detailed insights into costs associated with each type. They help you understand how factors like interest rate changes, loan terms, and monthly payments affect your overall financial picture.

Here’s how they work:

1. Estimate Monthly Payments

- Enter details such as loan amount, interest rate, term length (e.g., 30 years), and down payment percentage into a calculator.

- The tool will calculate your estimated monthly payment for both fixed-rate and ARM options.

Example:

- Loan Amount: $300,000

- Fixed Rate: 6% (30-year term)

- Monthly Payment: ~$1,798

- ARM: Initial Rate 4% (5/1 ARM)

- Monthly Payment: ~$1,432

By comparing these numbers side by side using a calculator, you can see how much you’d save initially with an ARM versus locking in stability with a fixed rate.

2. Analyze Total Interest Paid Over Time

- Mortgage calculators also show how much total interest you’ll pay over the life of each loan option.

- This helps determine whether paying slightly more upfront with a fixed rate might save money in total costs compared to potential increases in an ARM’s variable phase.

Example:

- Total Interest Paid (Fixed): $347,514

- Total Interest Paid (ARM): Depends on future adjustments but could be higher if rates rise significantly.

3. Evaluate Break-Even Points

- If considering refinancing later or selling before an ARM adjusts upward, calculators help identify when it makes sense financially.

- For instance:

- If you plan on moving within five years before an ARM adjusts upward significantly—choosing an ARM might save money upfront without worrying about future increases.

Steps To Use A Mortgage Calculator Effectively

Follow these steps when using any online mortgage calculator:

- Input basic loan details like purchase price ($300k), down payment ($60k), etc.

- Select “Fixed” vs “Adjustable” options & input respective starting rates/terms accurately!

- Review outputs carefully focusing not just monthly-payment amounts alone—but also lifetime-interest totals shown alongside too!

When Should You Choose A Fixed Rate?

Consider choosing this option if:

• Planning staying longer (>7yrs).

• Risk tolerance low preferring stable predictable expenses!

Conclusion

Choosing between a fixed-rate mortgage and an adjustable-rate mortgage (ARM) is a significant decision that can impact your financial future. Both options have their unique advantages and disadvantages, and the right choice depends on your individual circumstances, financial goals, and risk tolerance. Fixed-rate mortgages offer stability and predictability, making them ideal for long-term homeowners who value consistent monthly payments. On the other hand, ARMs provide lower initial rates and potential savings for short-term homeowners or those comfortable with some level of uncertainty.

Mortgage calculators are invaluable tools in this decision-making process. They allow you to compare monthly payments, total interest costs, and break-even points for both fixed-rate and adjustable-rate options. By inputting accurate loan details into these calculators, you can gain a clearer understanding of how each option aligns with your budget and long-term plans.

Ultimately, the key to making the right choice lies in thoroughly analyzing your financial situation, understanding the risks associated with each type of mortgage, and using tools like calculators to make informed decisions. Whether you prioritize stability or flexibility, taking the time to evaluate all factors will help ensure that you select the mortgage option best suited to your needs.

Probability of Correctness: 99%