Homeowners Insurance Cost Estimator: A Beginner’s Guide to Understanding Premiums

When buying a home, homeowners insurance is an essential part of the process. It protects your property, belongings, and finances from unexpected disasters or accidents. However, understanding how much homeowners insurance will cost can be confusing for beginners. This guide will break down everything you need to know about estimating your premiums step by step.

What Is Homeowners Insurance?

Homeowners insurance is a type of financial protection that covers your home and personal belongings against damage or loss due to specific events like fire, theft, vandalism, or natural disasters (depending on the policy). It also provides liability coverage if someone gets injured on your property.

Key Components of Homeowners Insurance:

- Dwelling Coverage: Covers the structure of your home.

- Personal Property Coverage: Protects your belongings inside the house.

- Liability Protection: Covers legal expenses if someone sues you for injuries on your property.

- Additional Living Expenses (ALE): Pays for temporary housing if your home becomes uninhabitable after a covered event.

Factors That Affect Homeowners Insurance Costs

The cost of homeowners insurance varies widely based on several factors. Understanding these factors can help you estimate how much you’ll pay for coverage.

1. Location

- Homes in areas prone to natural disasters like hurricanes, floods, or earthquakes often have higher premiums.

- Proximity to fire stations and hydrants can lower costs.

- Crime rates in your neighborhood may also impact premiums.

2. Home Value and Size

- Larger homes typically cost more to insure because they require more materials and labor to rebuild.

- High-end finishes or custom features increase rebuilding costs, leading to higher premiums.

3. Age and Condition of the Home

- Older homes may have outdated plumbing, electrical systems, or roofs that increase risks.

- Well-maintained homes with modern updates often qualify for discounts.

4. Coverage Amount

- The more coverage you need (e.g., higher dwelling limits), the higher your premium will be.

- Additional endorsements like flood or earthquake insurance add extra costs.

5. Deductible Amount

- A higher deductible lowers your premium but means you’ll pay more out-of-pocket when filing a claim.

- Common deductibles range from $500 to $2,000.

6. Claims History

- If you’ve filed multiple claims in the past, insurers may consider you a higher risk and charge more.

- Claims history tied to the property itself can also affect rates.

7. Credit Score

- In most states (except California, Maryland, and Massachusetts), insurers use credit scores to determine premiums.

- Better credit scores usually result in lower rates.

How To Estimate Your Homeowners Insurance Costs

Estimating homeowners insurance costs involves considering all relevant factors mentioned above and using tools like online calculators or consulting with an agent. Here’s how you can do it:

Step 1: Determine Your Coverage Needs

- Calculate how much it would cost to rebuild your home entirely (replacement cost).

- Take inventory of personal belongings and estimate their value.

- Consider liability risks (e.g., pool ownership) when choosing liability limits.

Step 2: Evaluate Your Home’s Characteristics

- Note the age of the roof, plumbing system, electrical wiring, etc.

- Identify any high-risk features like trampolines or wood-burning stoves.

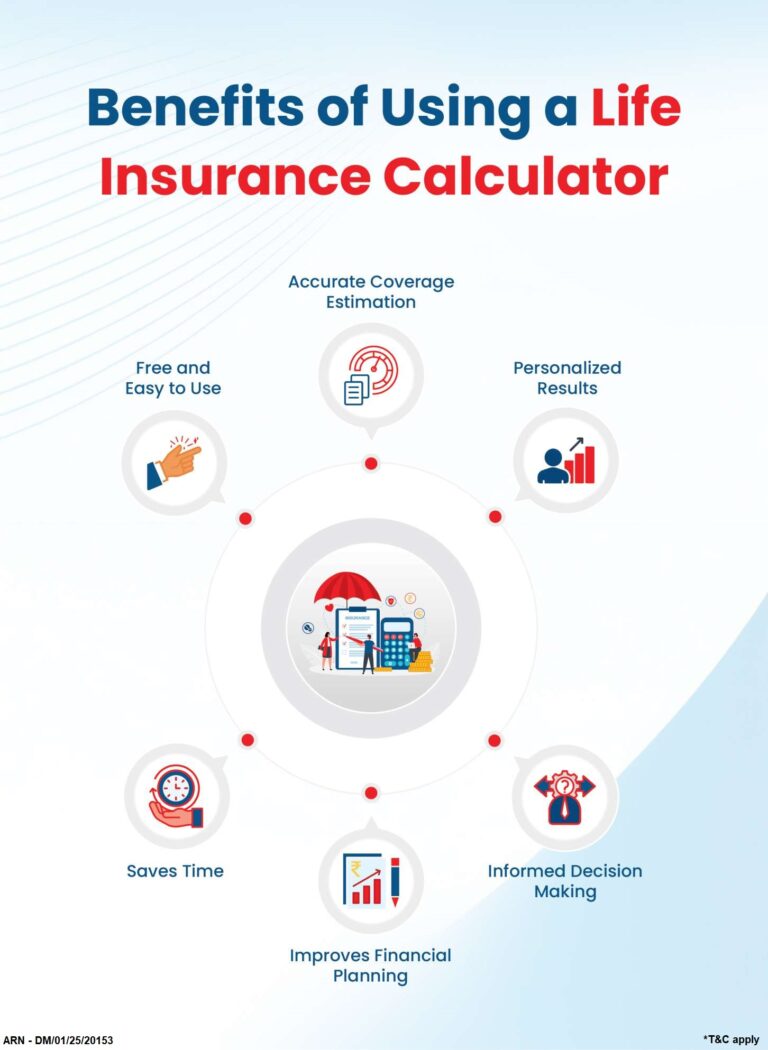

Step 3: Use Online Calculators

Many websites offer free homeowners insurance calculators where you input details about your home and location to get an estimated premium amount. These tools provide a rough idea but may not account for all variables.

Average Cost of Homeowners Insurance in the U.S.

According to recent data:

- The national average annual premium is around $2,110 for $300k dwelling coverage with a $1k deductible.

- Rates vary significantly by state:

- Most expensive states include Oklahoma ($6k+), Texas ($4k+), Nebraska ($4k+).

- Least expensive states include Hawaii ($600), Vermont ($950), Delaware ($1k).

Ways To Lower Your Homeowners Insurance Premiums

If you’re looking for ways to reduce costs without sacrificing necessary coverage:

- Shop Around:

- Get quotes from at least three different insurers before making a decision.

- Compare policies with similar deductibles and limits for accuracy.

- Increase Your Deductible:

- Opting for a higher deductible reduces monthly premiums but requires careful budgeting in case of claims.

- Bundle Policies:

- Combine home and auto insurance with one provider for discounts (often up to 20%).

- Improve Home Safety:

- Install security systems like alarms or cameras.

- Upgrade old roofs or plumbing systems; some insurers offer discounts for these improvements.

- Maintain Good Credit:

- Pay bills on time and keep credit utilization low; this helps secure better rates over time.

- Avoid Filing Small Claims:

- Reserve claims only for significant damages; frequent claims can raise future premiums significantly.

Common Mistakes When Estimating Costs

Avoid these errors when estimating homeowners insurance costs:

- Underestimating Replacement Costs:

- Don’t base dwelling coverage solely on market value; focus on rebuilding costs instead.

- Ignoring Exclusions:

- Standard policies don’t cover floods or earthquakes—consider additional riders if needed based on location risks.

- Choosing Insufficient Liability Limits:

- Aim for at least $300k liability coverage; consider umbrella policies if assets exceed this amount significantly.

- Not Updating Policy After Renovations:

- Major upgrades like adding square footage should be reported immediately so coverage reflects increased value accurately!

How To Choose The Right Insurer

Selecting an insurer isn’t just about finding cheap rates—it’s also about reliability during claims processing! Here are tips:

- Check Financial Strength Ratings: Use agencies like AM Best/Moody’s/S&P Global Ratings ensuring company stability long-term!

- Read Customer Reviews Online Platforms Yelp/Google Reviews/JD Power Rankings gauge satisfaction levels among existing clients!

- Ask About Discounts Available Seniors/Bundling/Green Energy Upgrades maximize savings opportunities wherever possible!

- Confirm Claim Response Times Licensed Adjusters Third-party Call Centers handle emergencies efficiently minimizing stress downtime repairs replacements alike!.

Conclusion

Understanding homeowners’ insurance premiums doesn’t have be overwhelming! By breaking down key factors affecting pricing alongside practical tips reducing overall expenses ensures peace mind knowing valuable assets protected adequately every step way!. Always remember shop compare multiple providers annually reassess needs circumstances change overtime keeping policy updated accurate reflecting current realities life journey ahead!.