How to Use an Insurance Calculator to Find the Best Policy for Your Needs

When it comes to buying insurance, whether it’s life, health, auto, or any other type of policy, one of the most important steps is determining how much coverage you need and what kind of policy fits your budget. This is where an insurance calculator becomes a valuable tool. It simplifies the process of estimating your insurance needs and helps you compare policies effectively. In this article, we’ll break down everything you need to know about using an insurance calculator step by step.

What Is an Insurance Calculator?

An insurance calculator is an online tool designed to help individuals estimate their insurance coverage needs and premium costs. By entering specific details such as age, income, debts, assets, and other financial information, the calculator provides a personalized estimate of how much coverage you might require and what it could cost.

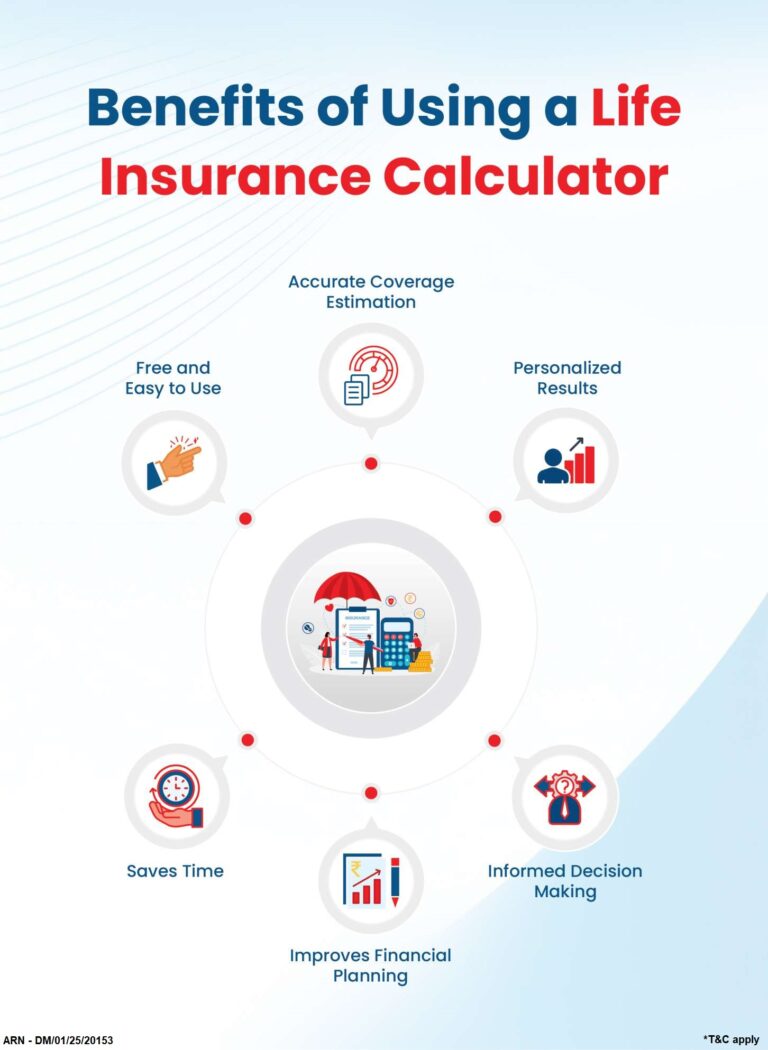

Benefits of Using an Insurance Calculator:

- Saves time by providing quick estimates.

- Helps you understand your financial needs better.

- Allows comparison between different policies.

- Offers insights into premium affordability.

- Reduces the chances of over-insuring or under-insuring yourself.

Step-by-Step Guide: How to Use an Insurance Calculator

Using an insurance calculator is straightforward if you follow these steps carefully. Let’s dive into each step in detail.

Step 1: Gather Your Financial Information

Before using any insurance calculator, it’s essential to have all your financial details ready. This ensures that the results are accurate and tailored to your situation.

Key Information You’ll Need:

- Income: Your annual or monthly income before taxes.

- Debts: Outstanding loans like mortgages, car loans, credit card balances.

- Assets: Savings accounts, investments, retirement funds.

- Expenses: Monthly living expenses such as rent/mortgage payments, utilities, groceries.

- Future Goals: Costs for children’s education or retirement planning.

Having this data on hand will make it easier to input accurate numbers into the calculator.

Step 2: Choose the Right Type of Insurance Calculator

There are different types of calculators available depending on the type of insurance you’re looking for. Selecting the right one ensures that you get relevant results.

Common Types of Insurance Calculators:

- Life Insurance Calculator:

- Estimates how much life insurance coverage you need based on income replacement and future expenses like college tuition or mortgage payments.

- Health Insurance Premium Calculator:

- Helps calculate monthly premiums based on factors like age, location, medical history.

- Auto Insurance Calculator:

- Provides estimates for car insurance premiums based on vehicle type, driving history.

- Homeowners/Renters Insurance Calculator:

- Calculates coverage needed for property damage or personal belongings.

- Business Insurance Calculator:

- Tailored for business owners to determine liability and property coverage requirements.

Choose a calculator that aligns with your specific needs.

Step 3: Input Accurate Details

Once you’ve selected the appropriate calculator, start entering your information accurately. The more precise your inputs are, the better the results will be.

Information Typically Required:

- Age and gender (for life/health insurance).

- Annual income (for life/disability insurance).

- Debt amounts (mortgage balance or credit card debt).

- Value of assets (savings/investments).

- Desired coverage amount (if known).

For example: If you’re using a life insurance calculator:

- Enter your current salary multiplied by the number of years you’d like to replace that income for your family after you’re gone.

- Add future expenses like college fees or funeral costs.

If you’re using a health insurance premium calculator:

- Provide details about pre-existing conditions if applicable.

- Include family size if you’re looking for family health plans.

Step 4: Review Results Carefully

After entering all required details into the calculator and submitting them, review the results provided by the tool carefully.

What Results Should You Expect?

- An estimate of how much coverage you need (e.g., $500K in life insurance).

- A breakdown of potential monthly premiums based on different policy options (e.g., term vs whole life policies).

- Suggestions for adjusting coverage levels if premiums seem too high or low compared to your budget.

Take note of these results but remember they are only estimates – actual quotes may vary depending on insurers’ underwriting processes.

Step 5: Compare Policies from Different Providers

One major advantage of using online calculators is that many tools allow comparisons between multiple providers directly within their platform. If not available within one tool itself:

Steps To Compare Policies Manually:

- Use multiple calculators from various insurers’ websites.

- Note down key metrics like premium costs & benefits offered under similar conditions across providers.

- Look out specifically at exclusions clauses while comparing policies side-by-side!

This comparison helps identify which insurer offers maximum value-for-money aligned closely w/your requirements!

Tips For Getting The Most Out Of An Insurance Calculator

Here are some practical tips to ensure you maximize the benefits of using an insurance calculator. Following these suggestions will help you get accurate results and make informed decisions about your insurance needs.

- Double-Check Your Inputs

Always verify the information you enter into the calculator. Even small errors, such as mistyping your income or debt amounts, can lead to inaccurate estimates. Double-checking ensures that the results reflect your actual financial situation. - Experiment with Different Scenarios

Use the calculator to test various scenarios by tweaking inputs like coverage amount, policy term, or deductible levels. This allows you to see how changes affect premiums and helps you find a balance between affordability and adequate coverage. - Consider Inflation

If you’re calculating long-term policies like life insurance or retirement health plans, factor in inflation. Future costs for education, healthcare, or living expenses may be higher than they are today. Some calculators include inflation adjustments—use this feature if available. - Understand Policy Types Beforehand

Familiarize yourself with different types of insurance policies (e.g., term life vs whole life insurance) before using a calculator. Knowing what each policy offers will help you interpret the results more effectively and choose the right option for your needs. - Use Multiple Calculators

Don’t rely on just one tool. Different insurers may have their own calculators with varying assumptions and algorithms. Using multiple calculators gives you a broader perspective on coverage requirements and premium estimates. - Consult an Expert After Calculation

While calculators provide valuable insights, they are not a substitute for professional advice. Once you’ve used a calculator to estimate your needs, consult an insurance agent or financial advisor to validate your findings and address any questions. - Look for Additional Features in Calculators

Some advanced calculators offer features like:- Side-by-side comparisons of policies from different providers.

- Recommendations based on your financial goals.

- Insights into tax benefits associated with certain policies (e.g., health savings accounts).

- Take advantage of these features if they’re available.

- Be Honest About Your Needs

When entering details into the calculator, be realistic about your lifestyle and future goals. Overestimating or underestimating your needs can result in either paying too much for unnecessary coverage or being inadequately insured when it matters most.

Common Mistakes to Avoid When Using an Insurance Calculator

While insurance calculators are helpful tools, there are some common mistakes people make that can lead to inaccurate results or poor decisions:

- Providing Incomplete Information: Leaving out key details like debts or future expenses can skew results.

- Ignoring Exclusions and Limitations: Calculators don’t always account for exclusions in policies—read policy documents carefully.

- Focusing Only on Premiums: Low premiums might seem attractive but could come with high deductibles or limited coverage.

- Not Updating Information Regularly: Life circumstances change over time; revisit calculations periodically to ensure they still align with your current situation.

- Skipping Professional Advice: Relying solely on online tools without consulting experts can lead to gaps in coverage.

Avoiding these pitfalls will help you use insurance calculators more effectively and make better decisions about your policies.

Conclusion

Using an insurance calculator is a smart way to estimate your coverage needs and compare policy options quickly and efficiently. By following the steps outlined above—gathering accurate financial data, choosing the right type of calculator, inputting precise details, reviewing results carefully, and comparing providers—you can take control of your insurance planning process with confidence.

Remember that while calculators provide valuable guidance, they should be used as part of a broader decision-making process that includes professional advice and thorough research into policy terms and conditions. With careful planning and informed choices, you’ll be well-equipped to find the best insurance policy for your unique needs!