What Is a Mortgage Affordability Calculator?

A mortgage affordability calculator is an online tool designed to help potential homebuyers estimate how much house they can afford based on their financial situation. It takes into account factors like your income, monthly expenses, debt obligations, interest rates, and down payment amount to provide an estimate of your home-buying budget.

These calculators are widely available on websites of banks, mortgage lenders, and financial institutions. They are free to use and provide quick insights into what price range of homes might be within your reach.

Why Do You Need a Mortgage Affordability Calculator?

Understanding your budget before starting the home-buying process is crucial. A mortgage affordability calculator helps you:

- Avoid overextending yourself financially.

- Narrow down your home search to properties within your price range.

- Plan for additional costs like property taxes and homeowners insurance.

- Get an idea of how much you’ll need for a down payment.

- Understand how different loan terms or interest rates affect your monthly payments.

By using this tool early in the process, you can save time and avoid disappointment by focusing only on homes that fit within your budget.

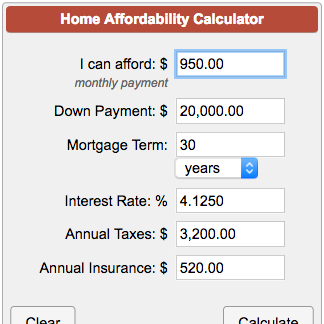

How Does a Mortgage Affordability Calculator Work?

A mortgage affordability calculator works by analyzing several key pieces of information about your finances. Here’s how it typically works step by step:

1. Input Your Income

- Enter your gross monthly income (before taxes). This includes wages from employment, rental income, or any other sources of steady income.

- If you’re buying with a partner or co-borrower, include their income as well.

2. Add Monthly Debts

- List all recurring monthly debts such as:

- Car loans

- Student loans

- Credit card payments

- Personal loans

- These debts are factored into your debt-to-income (DTI) ratio.

3. Specify Your Down Payment

- Indicate how much money you plan to put toward the down payment.

- A larger down payment reduces the loan amount and may lower monthly payments.

4. Include Interest Rate

- Input the current interest rate or use the default rate provided by the calculator.

- Interest rates significantly impact affordability since they determine how much you’ll pay in interest over time.

5. Set Loan Term

- Choose between common loan terms like 15 years or 30 years.

- Shorter loan terms have higher monthly payments but save money on interest in the long run.

6. Estimate Property Taxes and Insurance

- Many calculators allow you to input estimated property taxes and homeowners insurance costs.

- These costs are added to your monthly mortgage payment calculation.

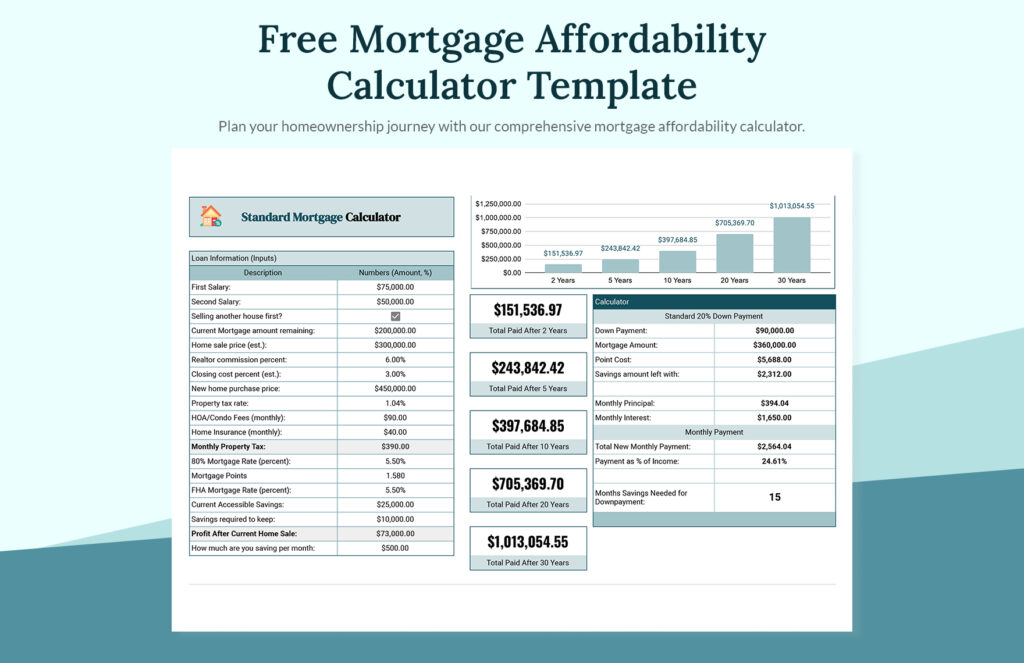

Once you’ve entered all this information, the calculator provides an estimate of:

- The maximum home price you can afford

- Your estimated monthly mortgage payment

Key Factors That Affect Mortgage Affordability

Several factors influence how much house you can afford. Let’s break them down:

1. Income

Your gross income determines how much money is available for housing expenses each month. Lenders typically recommend spending no more than 28% of your gross income on housing costs (including principal, interest, taxes, and insurance).

2. Debt-to-Income Ratio (DTI)

The DTI ratio compares your total monthly debt payments to your gross monthly income:

- Front-end DTI: Focuses only on housing expenses (should not exceed 28%).

- Back-end DTI: Includes all debts (should not exceed 36%-43%).

Lenders use these ratios to assess whether you’re financially stable enough for a mortgage.

3. Credit Score

Your credit score affects the interest rate offered by lenders:

- Higher credit scores qualify for lower rates.

- Lower credit scores may result in higher rates or even denial of loans.

4. Down Payment

The size of your down payment impacts affordability:

- Larger down payments reduce loan amounts and eliminate private mortgage insurance (PMI) if it’s at least 20%.

- Smaller down payments increase monthly costs due to PMI requirements.

5. Interest Rates

Interest rates fluctuate based on market conditions and personal factors like creditworthiness:

- Lower rates mean smaller monthly payments.

- Higher rates reduce purchasing power.

Benefits of Using a Mortgage Affordability Calculator

Using a mortgage affordability calculator offers several advantages:

- Quick Estimates: Get instant results without needing professional assistance.

- Budget Planning: Helps set realistic expectations for what kind of house fits within your means.

- Customization: Adjust variables like loan term or interest rate to see different scenarios.

- Confidence: Approach lenders with confidence knowing what price range works for you.

- Time-Saving: Focus only on homes that match your budget instead of wasting time on unaffordable options.

How Accurate Are Mortgage Affordability Calculators?

While these tools provide valuable estimates, they are not foolproof because they rely on user-provided data and assumptions about future expenses or changes in financial circumstances.

Factors that may affect accuracy include:

- Inaccurate input data (e.g., underestimating debts).

- Fluctuating interest rates during preapproval or closing stages.

- Exclusion of hidden costs like HOA fees or maintenance expenses.

For precise calculations tailored specifically to your situation, consult with a lender who can review detailed financial documents such as tax returns and bank statements.

Tips for Using a Mortgage Affordability Calculator Effectively

To get the most out of this tool:

- Be Honest About Finances: Input accurate numbers for income and expenses—don’t guess!

- Account for Hidden Costs: Include estimates for utilities, maintenance fees, HOA dues if applicable.

- Experiment With Variables: Test different scenarios by adjusting loan terms or increasing/downscaling budgets based on savings goals.

- Use Multiple Calculators: Compare results from various platforms since each uses slightly different algorithms/assumptions behind-the-scenes calculations!

Common Mistakes When Using Mortgage Affordability Calculators

Avoid these pitfalls when using these tools:

- Ignoring Additional Costs Beyond Principal & Interest Payments

- Overestimating Future Income Growth Potential

- Assuming Fixed Rates Will Stay Constant Forever

Remember always double-check final numbers against professional advice before making commitments!

Conclusion

In conclusion, a mortgage affordability calculator is an essential tool that simplifies one aspect of buying a home—determining what fits within your budget! By understanding its purpose and using it effectively alongside professional guidance from lenders/brokers—you’ll be better prepared financially while avoiding costly mistakes along way!