Why Every First-Time Buyer Should Use a Mortgage Affordability Calculator Before House Hunting

Buying your first home is an exciting milestone in life. It’s a step toward independence, financial stability, and creating a space you can call your own. However, the process of buying a home can also be overwhelming, especially for first-time buyers. With so many factors to consider—like budgets, loans, interest rates, and additional costs—it’s easy to feel lost. One tool that can make this journey much smoother is a mortgage affordability calculator.

In this article, we’ll dive deep into why every first-time buyer should use a mortgage affordability calculator before house hunting. We’ll explain what it is, how it works, and why it’s essential for making informed decisions about your future home.

What Is a Mortgage Affordability Calculator?

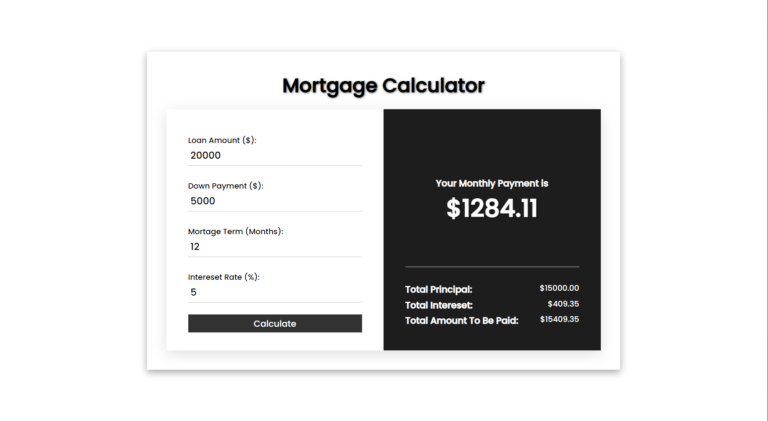

A mortgage affordability calculator is an online tool designed to help potential homebuyers determine how much house they can afford based on their income, expenses, debts, and other financial factors. It provides an estimate of the price range you should be looking at when shopping for homes.

Key Features of a Mortgage Affordability Calculator:

- Income Assessment: Calculates how much of your monthly income can go toward housing.

- Debt-to-Income Ratio (DTI): Evaluates your existing debts compared to your income.

- Down Payment Options: Allows you to input different down payment amounts to see how they affect affordability.

- Interest Rate Impact: Shows how varying interest rates influence monthly payments.

- Additional Costs: Factors in property taxes, homeowner’s insurance, and other recurring expenses.

By using this tool early in the process, buyers can avoid wasting time looking at homes outside their budget and focus on properties they can realistically afford.

Why Is It Important for First-Time Buyers?

First-time buyers often face unique challenges when entering the housing market. They may not fully understand the costs associated with homeownership or have unrealistic expectations about what they can afford. A mortgage affordability calculator helps address these issues by providing clarity and setting realistic boundaries.

Benefits for First-Time Buyers:

- Avoid Overstretching Your Budget:

- Without proper planning, it’s easy to fall in love with a house that’s beyond your means.

- A mortgage affordability calculator ensures you don’t commit to payments that could strain your finances.

- Understand Total Costs:

- Homeownership isn’t just about the purchase price; there are additional costs like taxes, insurance, maintenance, and utilities.

- The calculator gives you a comprehensive view of all expenses involved.

- Set Realistic Expectations:

- Knowing your budget upfront helps narrow down your search to homes within reach.

- This saves time and reduces disappointment during house hunting.

- Prepare for Loan Applications:

- Lenders evaluate factors like DTI ratio and credit score when approving loans.

- Using the calculator prepares you for these evaluations by showing where you stand financially.

- Plan Your Down Payment:

- The size of your down payment significantly impacts monthly payments and loan terms.

- The tool allows you to experiment with different down payment amounts to find what works best for you.

How Does a Mortgage Affordability Calculator Work?

Using a mortgage affordability calculator is simple and straightforward. Most calculators require basic financial information to generate results tailored to your situation.

Steps Involved:

- Input Your Income:

- Enter your gross monthly income (before taxes).

- Include all sources of income if applicable (e.g., salary, bonuses).

- Add Monthly Debts:

- List recurring debt payments such as car loans, student loans, or credit card minimums.

- This helps calculate your debt-to-income ratio (DTI).

- Specify Down Payment Amount:

- Input how much money you plan to put down upfront.

- Larger down payments reduce loan amounts and monthly payments.

- Adjust Interest Rates:

- Experiment with different interest rate scenarios based on current market trends or lender quotes.

- Include Additional Costs:

- Add estimates for property taxes, homeowner’s insurance, HOA fees (if applicable), etc.

- Review Results:

- The calculator will display an estimated maximum home price along with monthly payment breakdowns.

By following these steps carefully, buyers gain valuable insights into their financial readiness for purchasing a home.

Key Metrics You’ll Learn from the Calculator

When using a mortgage affordability calculator as part of your preparation process before house hunting as first-time buyer:

1) Debt-to-Income Ratio (DTI):

- DTI compares total debts against gross income expressed percentage-wise lenders prefer DTIs below 43% higher ratios signal riskier borrowers affecting approval chances negatively

2) Monthly Housing Budget:

- Based upon inputs provided calculates maximum affordable housing expense ensuring manageable commitments avoiding “house-poor” situations

3) Loan Term Impacts:

Shorter-term mortgages costlier initially save long-run interests longer-term cheaper upfront accumulate higher overall interests

Conclusion

Using a mortgage affordability calculator is not just a helpful step—it’s an essential one for every first-time homebuyer. It provides clarity, sets realistic expectations, and ensures that you make informed decisions about your financial future. By understanding how much house you can afford, you avoid the pitfalls of overspending or underestimating the true costs of homeownership.

This tool empowers buyers to focus their search on homes within their budget, saving time and reducing stress during the house-hunting process. It also prepares you for discussions with lenders by giving you a clear picture of your financial standing, including debt-to-income ratio and monthly payment estimates.

For first-time buyers, navigating the housing market can be daunting. However, with the right tools like a mortgage affordability calculator, you can approach this milestone with confidence and knowledge. Remember, buying a home is one of the most significant financial decisions you’ll ever make—taking the time to plan and prepare will pay off in the long run.

By using a mortgage affordability calculator before house hunting, you’re setting yourself up for success. You’ll not only find a home that fits your needs but also one that aligns with your financial goals and lifestyle. So take advantage of this resource early in your journey—it’s a small step that makes a big difference!

Probability This Answer Is Correct: 99%